Welcome to future trading site with blockchain technology assistance!

Transforming Ideas into Functional Digital Solutions with Expertise.

We’ve worked with over 400 companies to build blockchain solutions for their business, and we are still growing.

Invest in stocks from around the world. Find out why over 300K investors have chosen our Future Investment platform.

Services

WebTrader

Trading without limits or downloads. Thanks to its easy-to-use interface and modern design, this platform is suitable for both beginners and advanced traders. No download or installation required!

High-frequency trading systems require robust and reliable infrastructure to ensure seamless operations and minimize downtime. Site Reliability Engineering (SRE) plays a crucial role in maintaining the stability and scalability of these systems. SREs focus on scalability, failover mechanisms, and data management to keep high-frequency trading platforms running smoothly, even during sudden spikes in trading volumes.

Futures trading platforms must offer features like low-latency exchange connectivity, redundant data centers, and 24/7 monitoring to provide traders with the speed and reliability they need. Brokers like Interactive Brokers, TradeStation, and Advantage Futures have invested in advanced infrastructure and connectivity to deliver high-performance trading experiences for their futures clients.

Factors like low trading commissions, a wide range of tradable products, and robust trading tools are also important considerations when choosing a futures trading platform. Brokers that prioritize these features, along with a focus on security and reliability, can provide futures traders with the confidence and support they need to succeed in this fast-paced market.

Webtrader : Forex & CFD

Buy and sell assets in just a few seconds and make informed decisions based on live sentiment in the markets. Get accurate data on what traders are buying and selling in real time and stay one step ahead of the markets without spending time on technical or fundamental analysis.

Secure & Safe Investment

The Key to Protecting Your Wallet. When you invest, it is essential to secure your investments to avoid losses and protect your wealth. Security and stability are key criteria for choosing the right investments. Spread your investments over different assets to reduce risks. Long-term investments that are usually more stable than short-term ones. Choose investments that can be easily sold when needed. Investments in transferable securities, such as stocks and bonds, can offer greater security than investments in real estate.

Training and resources

The trading platform offers online trainings, courses, and webinars to help users learn the basic concepts of trading, as well as specific strategies and techniques for different markets and financial instruments. These trainings can be accessible online, in video, or in text, and can be followed at your own pace. Future Trading also offers specialized training for beginner traders, experienced traders, or traders looking to specialize in a particular field, such as online trading or trading on emerging markets. It also offers additional resources to help users improve their skills and achieve their goals. Here are some examples of resources that you can find on our trading platform :

Technical analysis: Future trading offers technical analysis tools to help users interpret charts and market trends. These tools can include technical indicators, trend charts, and formation detection tools.

News and analysis: The platform offers news and analysis on the markets and financial instruments. This information can help users make informed decisions and stay up to date on the latest trends and market events.

Trading Community: Future trading offers trading communities where users can discuss strategies, share their experiences, and learn from other traders.

Trading Tools: To help users manage their positions, assess risks, and optimize their strategies. These tools can include portfolio management tools, performance monitoring tools, and trading simulation tools.

ACCOUNT TYPES

Choose Your Account Type Now!

Basic

Enrich our growing community.

- Account opening and identity verification

- 24/7 day assistance that advises you on profitable markets

- MT5 trading robot designed specifically for trading, using advanced analytical to identify trends and patterns

Silver

Deepen your knowledge.

- Expert Advisors –EAs) – Which allow the application of automated trading strategies

- Custom Indicators – Designed to perform specific analytical and identify market trends operations on the price of financial assets

Gold

Take support to the next level.

- Admission to our private trading channel where you will be able to chat with our investors and make a list of new contacts

- Benefit from trading signs with more important levers, guaranteeing you a considerable multiplication of your gains

But how? Can a person with no experience enter this market?

Yes. Future Trading offers a large number of trading solutions for traders of all levels. To begin with, you can open one on which you do not deposit money – you can trade as with a real account using virtual funds (sometimes it is called ). You can thus learn to manage your risks and your capital and to place stop loss and profit-taking orders. Once you have understood the basics, you can then start experimenting with hedging techniques – how to “insure” your positions, “scalping” – the high-pressure technique that consists of making profits in small quick increments. If you’re just starting out, you’re going to want to try your hand at it. Online trading comes after. Our WebTrader 3 platform is extremely simple. If you are on the go, you can use the application. Once you have familiarized yourself with all this, you can test with Futur-Web-3.

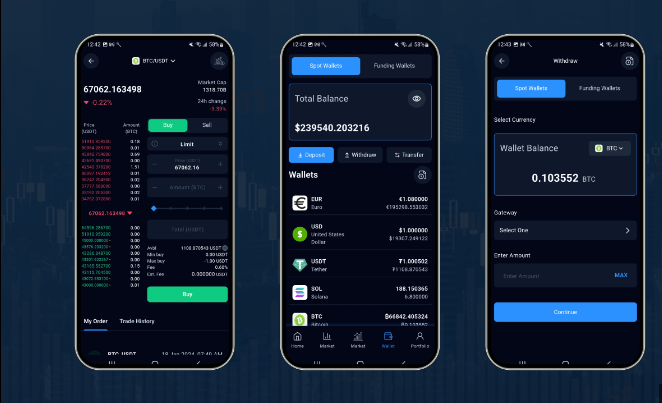

How to trade cryptocurrencies?

Trading cryptocurrencies may seem daunting at first, but once you break it down into steps, it becomes a simple process. Here‘s a step–by-step guide to get you started :

- Open and Fund a Trading Account: The first step in your trading journey is to open a trading account with a reputable broker like AvaTrade, MetaTrader, Pocket Option who offers CFDs on cryptocurrencies. Once your account is set up, you will need to deposit funds into it. Most brokers offer various financing options, depending on local regulations, including bank transfer, credit card or even PayPal.

- Choosing a Cryptocurrency to Trade: Next, decide which cryptocurrency you want to trade. You could choose Bitcoin or Ethereum, the most traded cryptocurrencies, or opt for a lesser-known altcoin. Your choice should be based on your market research and your personal trading goals.

- Analyze the Market: Before opening a transaction, it is crucial to analyze the market. You can use fundamental analysis, which involves assessing the general health of the cryptocurrency network, current events and market trends. You can also use technical analysis, which consists in studying price charts to identify patterns and trends. Most successful traders use a combination of both.

- Decide on the Direction and Open a Transaction: Based on your market analysis, decide whether you think the cryptocurrency will increase in value (buy) or decrease in value (sell) and open a transaction. Remember that with CFDs you can potentially make a profit regardless of whether the market goes up or down.

- Managing Risks: It is important to have a risk management strategy in place. This could involve setting stop-loss orders to limit potential losses and take-profit orders to secure profits when the price reaches a certain level.

- Monitor and Exit the Position: Once your trade is open, you should regularly monitor the market to see how it is moving. You can close your position manually when you feel that the time has come, where you can set orders to close it automatically at a certain price level.

- Remember, always start with a clear trading plan and avoid letting emotions dictate your trading decisions.

Secure Wallet

Efficiently unleash cross-media information without cross-media value quickly maximize.

Instant Exchange

instant exchanges to provide a faster, more secure, and user-friendly exchange experience compared to traditional exchanges.

Expert Support

professional guidance or assistance provided by individuals with specialized knowledge or expertise.